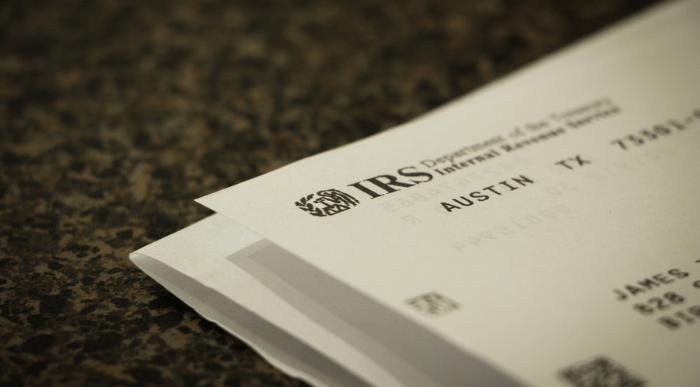

The IRS Announces No More Surprise Visits In a move to enhance public trust and safety, the Internal Revenue Service (IRS) has declared a significant shift in its operations. The agency will cease most of its unannounced visits to taxpayers, a practice that has been in place for several decades. This decision is part of […]

5 Steps to Solve a Surprise Tax Notice Receiving an unexpected tax notice can be a jarring experience, leaving you scrambling to figure out how to handle the sudden financial burden. While it’s easy to feel overwhelmed, taking immediate action is crucial to resolving the issue effectively. This article outlines five steps to take when […]

The Legal Consequences of Ignoring Tax Debt Tax debt is a burden that many people carry, often due to circumstances beyond their control. However, ignoring this debt is not a solution and can lead to severe legal consequences. If you’re tempted to sweep your tax debt under the rug, think again! This article aims to […]

Understanding IRS Tax Debt Penalties When it comes to taxes, it’s important to understand that failure to comply with the Internal Revenue Service (IRS) regulations can result in penalties. These penalties serve as a deterrent and encourage taxpayers to fulfill their obligations. In this comprehensive guide, we will explore the different types of IRS tax […]

The Wage Garnishment Process: How It Works Being indebted to the IRS can incur a slew of consequences, one of which is called wage garnishment. The term alone is enough to elicit fear in any of us, but we’re here to tell you that there’s nothing to be afraid of. By understanding what wage garnishment […]

Understanding Tax Liens The consequences of carrying tax debt are never static. The longer that debt goes unaddressed, the more severe the penalties become. One such penalty is a “tax lien”, a phrase that elicits images of property seizure and total financial collapse. There’s nothing to be afraid of. Understanding what a tax lien is, […]

What You Need to Know About Property Seizure by the IRS Picture this: You’re enjoying a peaceful day when suddenly there’s a knock on your door. To your surprise, it’s not a neighbor or a delivery person—it’s the Internal Revenue Service (IRS), armed with the power to seize your property. What are you supposed to […]

IRS Auditing Explained An audit from the Internal Revenue Service (IRS) can be a substantial interruption to your life. The complexities of tax law are not a concern for most people, but once that audit notice is received, you have a responsibility to the IRS and to yourself to respond appropriately. There’s no need to […]

How to Respond to an IRS Notice Receiving an official notice from the Internal Revenue Service (IRS) can be a frightening experience, but don’t panic! Responding to an IRS notice doesn’t have to be a nerve-wracking experience. With a clear understanding of the process and the assistance of a qualified tax attorney, you can navigate […]

Resolving Tax Debt: Why Hiring a Professional Matters Dealing with tax debt can be a daunting and complex process. It requires knowledge of intricate tax laws, expertise in negotiation and advocacy, and a thorough understanding of the tax resolution options available. While some individuals attempt to resolve their tax debt on their own, hiring a […]