Top 10 Celebrity Tax Evasion Cases

Celebrities often enjoy the perks of wealth and fame, but when it comes to the IRS, they face the same scrutiny as everyone else. Tax issues can lead to significant legal and financial consequences, as evidenced by these 10 high-profile celebrity tax evasion cases.

Let’s take a look at some of the most infamous tax blunders in the history of stardom.

1. Wesley Snipes: Failure to File

Actor Wesley Snipes faced severe tax troubles when he failed to file tax returns from 1999 to 2001, accumulating $41 million in tax debt. Convicted on three misdemeanor charges, Snipes served a three-year prison sentence from 2010 to 2013. Despite acquittal on more serious charges, his case underscores the importance of timely tax filing.

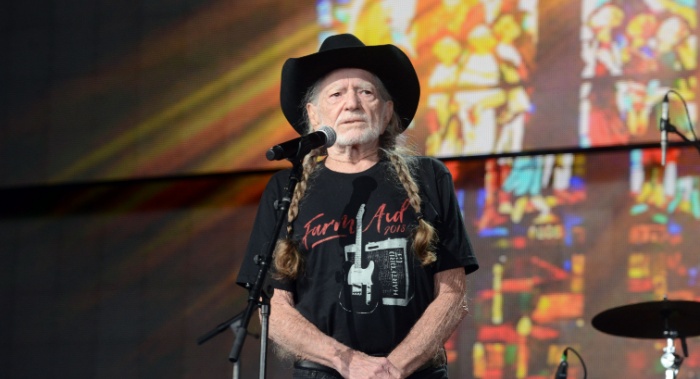

2. Willie Nelson: Hidden Income

Country music legend Willie Nelson’s tax saga began in 1990 when the IRS seized his assets for hiding income in tax shelters, leading to a $16 million tax bill. To settle his debt, Nelson released the album “The IRS Tapes: Who’ll Buy My Memories” and starred in a Super Bowl ad for H&R Block. By 1993, he had resolved his tax issues.

3. Hunter Biden: Failure to Pay

Hunter Biden, son of President Joe Biden, agreed to plead guilty to misdemeanor charges for failing to pay taxes on a $1.5 million income in 2017 and 2018. Expected to receive probation, his case highlights the consequences of neglecting tax obligations.

4. Lauryn Hill: Failure to File

Grammy-winning artist Lauryn Hill served nearly three months in prison in 2013 for failing to file tax returns from 2005 to 2007, during which she earned almost $2 million. In addition to jail time, Hill paid over $970,000 in back taxes and fines.

5. Martha Stewart: State Residency Fraud

In 1994, Martha Stewart settled with New York state by paying over $220,000 in back taxes after being found to falsely claim residency in Connecticut. This case, occurring a decade before her insider trading scandal, emphasizes the importance of accurate state residency claims.

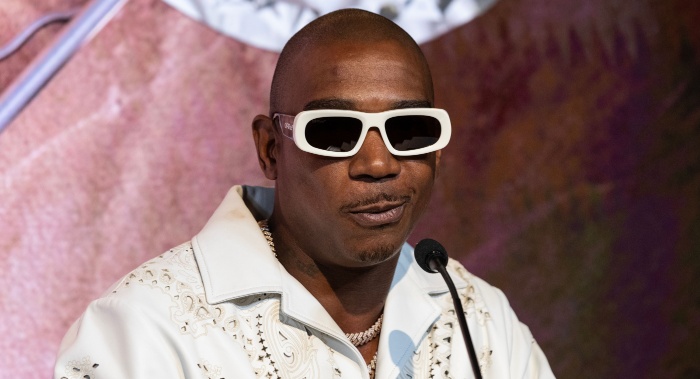

6. Ja Rule: Failure to File

Rapper Ja Rule, or Jeffrey Atkins, was imprisoned for two years in 2013 for failing to file tax returns from 2004 to 2008, resulting in over $1 million in tax debt. His legal issues extended beyond his prison term, with additional tax suits filed against him and his wife in 2021.

7. Lindsay Lohan: Failure to Pay

Actress Lindsay Lohan faced significant IRS actions in 2012 when her bank accounts were seized to cover $230,000 in unpaid taxes. Despite receiving financial help from Charlie Sheen, she continued to face tax liens for years, illustrating the ongoing nature of tax debts.

8. Chuck Berry: Filing False Returns

Rock and roll pioneer Chuck Berry served four months in prison and received a probation sentence in 1979 for evading $109,000 in taxes and filing false returns. His insistence on cash payments and subsequent IRS investigation highlight the pitfalls of improper income reporting.

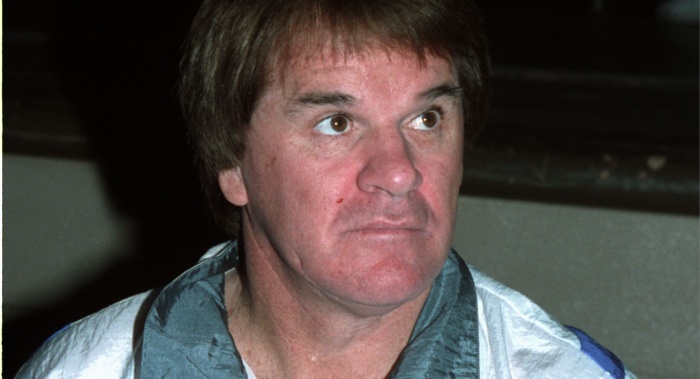

9. Pete Rose: Failure to Report All Income

Baseball legend Pete Rose spent five months in prison in 1990 for failing to report $350,000 in income from memorabilia sales. His tax issues persisted, with the IRS placing additional liens on him for back taxes in subsequent years.

10. Lil Wayne: Failure to Pay

Rapper Lil Wayne settled a $7.7 million tax debt in 2012 after the IRS threatened to seize his Miami mansion. His case, which included help from fellow rapper Jay-Z, underscores the significance of resolving large tax debts to avoid severe consequences.

The Importance of Professional Help

These celebrity cases highlight the severe repercussions of tax issues. Whether it’s failure to file, hidden income, or residency fraud, the consequences can be dire. If you’re facing tax debt, professional assistance is crucial. At TaxDebtLawyer.net we provide free consultations with qualified tax attorneys who can help you navigate complex tax situations and find the best solutions for your specific needs.

Learning a Lesson

Tax issues can affect anyone, from ordinary citizens to high-profile celebrities. Learning from these cases, it’s clear that addressing tax debts promptly and accurately is essential. Visit TaxDebtLawyer.net today to connect with an experienced tax attorney and take the first step towards resolving your tax debt issues.

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems